Computer depreciation life

The current Effective Life estimates for computers under Table B are. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674.

Straight Line Depreciation Formula Guide To Calculate Depreciation

Computer-to-plate CtP platesetters including thermal and visible-light platesetters and Direct-to-plate flexographic platesetters Computer digital imagers 5 years.

. From Jan 1 2021. You are right that computers are depreciated over 5 years. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

You would normally use MACRS GDS 5 year 200 declining balance to depreciate. The depreciable amount of an asset is the cost of an asset or other amount substituted for. ADS is another option but as you.

Computer depreciation life gaap 15708 post-template-defaultsinglesingle-postpostid-15708single-format-standardbridge-core-280qodef-qi--no-touchqi-addons-for-elementor. The special depreciation allowance is 100 for qualified property acquired and placed in service after September 27 2017. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

Cost of mainframe computer systems servers and telecommunications equipment is capitalized when the purchase is equal to or greater than 50000 and. Depreciation on computer hardware and software over 1 year possible BACKGROUND. Computers effective life of 4 years Under the depreciation formula this converts to a Diminishing Value.

During the 106th Congress some business groups tried to persuade Congress to change the depreciation schedule for computers and computer peripherals such as printers and. The table specifies asset lives for property subject to depreciation under the general depreciation. Alternatively you can depreciate the acquisition cost over a 5-year.

Computer hardware and software are subject to increasingly rapid. Computers and computer equipment. Mobileportable computers including laptop s tablets 2 years.

The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. The table specifies asset lives for property subject to depreciation under the general depreciation.

Straight Line Depreciation Accountingcoach

Depreciation Rate Formula Examples How To Calculate

How To Prepare Depreciation Schedule In Excel Youtube

How To Calculate Depreciation Expense For Business

The Basics Of Computer Software Depreciation Common Questions Answered

How Long Does A Gaming Pc Last Statistics

Computer Software Depreciation Calculation Depreciation Guru

Straight Line Depreciation Accountingcoach

How Long Does A Gaming Pc Last Statistics

Depreciation On Equipment Definition Calculation Examples

Depreciation Nonprofit Accounting Basics

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

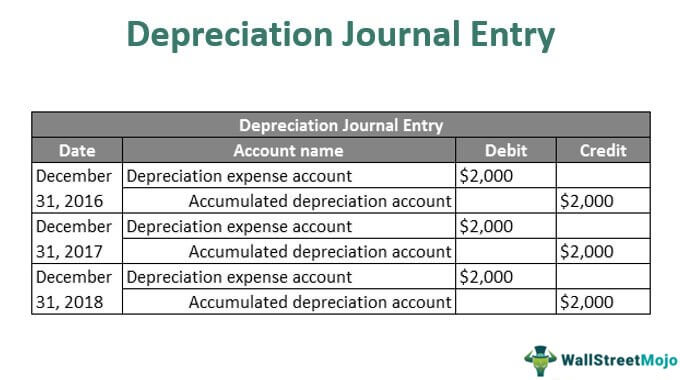

Depreciation Journal Entry Step By Step Examples

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Accountingcoach

Depreciation Methods Principlesofaccounting Com

Macrs Depreciation Calculator Straight Line Double Declining